Tiger Sport

TigerSport Football and Basketball Game Analysis

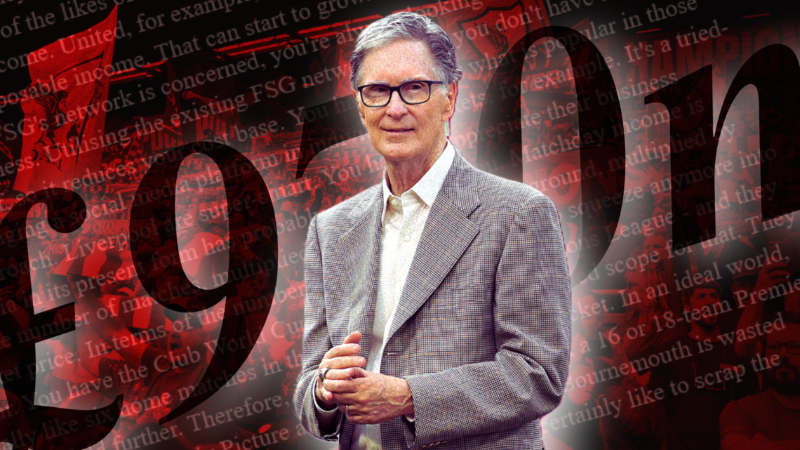

Liverpool owners FSG set for second round of talks as £970m deal could reshape John Henry's empire

07-28 21:10Views 5930

John Henry, the primary figure behind Fenway Sports Group (FSG), is the key investor controlling Liverpool Football Club. His vast wealth, reportedly £4.5bn, is significantly tied to Liverpool, a club that offers unparalleled global prestige and influence, far exceeding its current profitability compared to FSG's MLB and NHL teams. Owning the six-time European champions grants immense access and business opportunities. While FSG hasn't yet realized the full return on their £300m 2010 investment, Liverpool's value is now estimated at £4-5bn.

Following a second Premier League title under their ownership and a potentially historic transfer window involving record-breaking signings, FSG has no plans to sell Liverpool. CEO Billy Hogan has explicitly stated the ownership's "absolute commitment" to the club. Commercially, Liverpool is thriving, with significant growth in sponsorship, retail, and matchday income funding major transfers like Wirtz, Ekitike, Frimpong, and Kerkez, with the financial capacity to pursue Newcastle's Alexander Isak.

Despite earlier statements about consolidation, FSG is actively expanding its portfolio beyond Liverpool. They are pursuing a multi-club model, with La Liga's Levante identified as a potential acquisition target after talks with Malaga and Getafe collapsed, and are also exploring a takeover in rugby.

Simultaneously, FSG is considering a major financial move involving the Pittsburgh Penguins, their NHL franchise acquired for £650m in 2021 and considered one of their most valuable assets. FSG revealed plans in January to sell a minority stake in the Penguins, mirroring the strategy used with Liverpool when they sold a ~3% stake to Dynasty Equity for £127m in late 2023. Such a sale could represent the single biggest windfall of FSG's career.

Related Comments(5842)