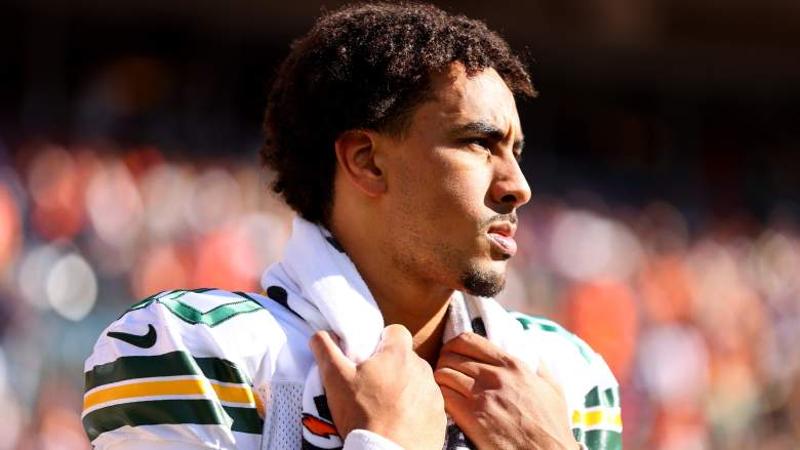

Major Packers Update Puts Jordan Love on Notice

07-08 10:21Vis. 2351

The Green Bay Packers, historically consistent at quarterback, face potential change as Jordan Love enters a critical phase. Despite showing franchise quarterback potential, Love's performance plateaued in his second season as starter following a massive four-year, $220 million contract extension signed in 2024. His passing productivity decreased, resulting in another 9-win season and an 18-15 career record.

Love's top-five quarterback contract demands significant improvement in his third season as the starter, specifically requiring him to elevate his teammates. Failure to progress could place him on the hot seat, especially as his salary cap hits increase later in the contract. The Packers retain flexibility through rolling guarantees, giving them power over his future.

Newly promoted Packers CEO Ed Policy, replacing the retiring Mark Murphy, is identified as a potential decision-maker who might move on from Love if performance doesn't meet contract expectations. Analysis suggests Love needs to play better in 2025 to avoid being firmly on the hot seat in 2026.

Critically, Love's performance has been hampered by issues with pass-catchers; he led the NFL with 32.7% of third-down incompletions attributed to receiver faults. This sparked calls for the team to acquire a top-tier wide receiver like DK Metcalf or Davante Adams.

However, the Packers prioritized strengthening their offensive line during the offseason, signing Aaron Banks and negotiating with Zach Tom, instead of adding a star receiver. The team is relying on its player development program to produce receiving talent.

The onus is now squarely on Love to elevate the young players around him. With only three players on the roster predating him, his top-market contract means he must lift his teammates. His ability to navigate competitions at left tackle and receiver, and perform through resulting challenges, will be crucial to the team's success in the upcoming season.

Comentários(588)